How to Determine a Downtrend Is Reversing

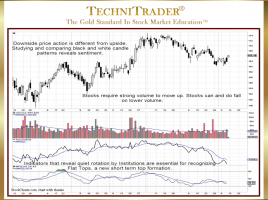

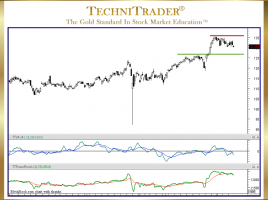

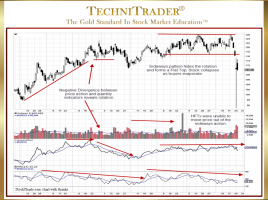

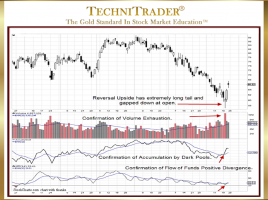

Use Leading Indicators to Identify Confirmation Technical Traders and Retail Traders need to be able to identify Reversal Candlestick Patterns during a Downtrend in order to avoid huge losses on Selling Short Trades and to be prepared and ready for early entry in the reversal of the trend. When a …