Stock Chart Platform Compression Patterns for Early Entries

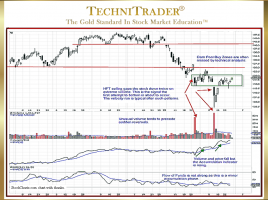

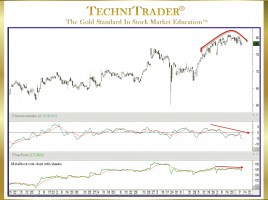

Trade with Professional Traders for Higher Profits The stock chart example below recently had a strong “Pop Out of the Box” Candlestick Pattern after a Platform Compression Pattern. Preceding the compression, the price action was a Trading Range. Oftentimes, Trading Ranges compress into a tighter formation when Dark Pool Quiet …