How to Identify Downside Breakouts Prior to a Top

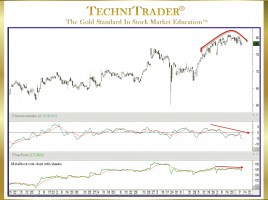

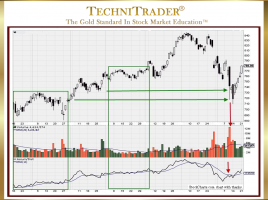

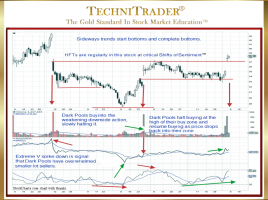

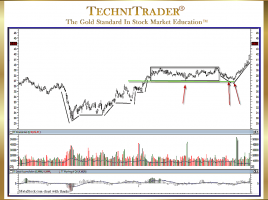

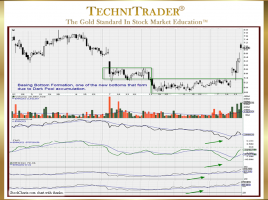

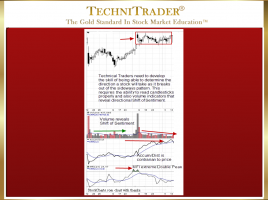

Recognize Shift of Sentiment™ Patterns in Indicators One of the more frustrating patterns for many Technical Traders and Retail Traders are the Flat Top Candlestick Patterns that form today. These new Topping Formations surprise many traders and result in whipsaw trades and losses with breakouts to the downside. What appears …