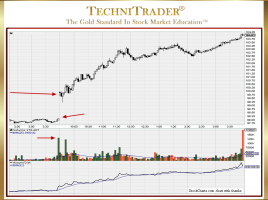

How Does a Percentage Stop Loss Trigger High Frequency Traders?

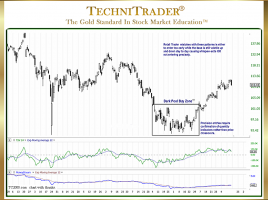

They Trigger on Algorithms Designed to Locate Cluster Orders The uptrend and the downtrend are not mirror images of each other, nor can you use the exact same indicators, indicator period settings, or subordinate indicators. The downtrend can drop and gap down on low stock Volume because a percentage stop …