How to Interpret Bollinger Bands® Direction of Breakout

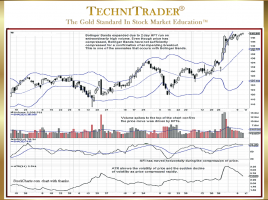

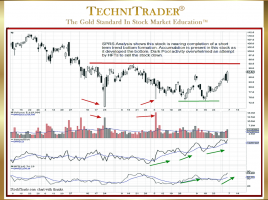

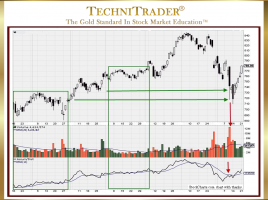

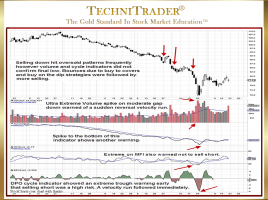

Dramatically Improve Interpretation with Simple Techniques Trading with Bollinger Bands is easily enhanced with a few simple techniques you can start using right away. The first step is proper interpretation of Bollinger Bands for stock trading. There are Bollinger Bands trading signals you can learn by simply adding another indicator …