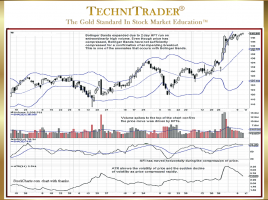

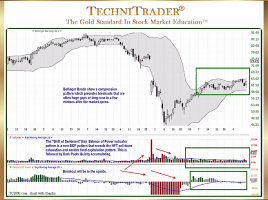

What Is the Buy Side Institutions’ Influence on Price & Stock Volume?

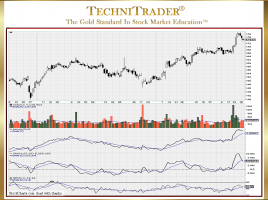

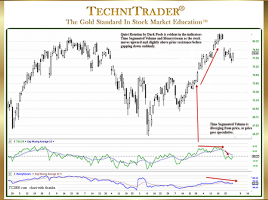

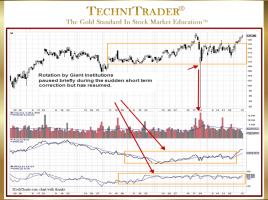

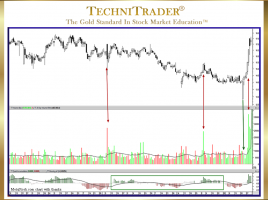

The Importance of Rising and Falling Stock Volume Patterns Stock Volume provides easy-to-read information regarding the liquidity for a stock at a particular time. Falling stock Volume often precedes the slip slide action when Price falls, not due to profit taking or selling short, but simply because there are insufficient …