The Fed’s Interest Rates Conundrum – Part 2

How Low Interest Rates Have Created a Hidden Inflationary Economy

This is Part 2 of a series of articles regarding the Federal Reserve Board’s recent statement that they do not understand why inflation remains below 2% as they proclaim a robust economy.

The primary method the Feds use in their attempt to control the economy or the Stock Market is to raise or lower the interest rates to the big banks that need to borrow overnight money to meet shortages on obligations. The adjustment to interest rates has been used as an attempt to slow down the Technology Stock Market Bubble, but it failed. It was also used to attempt to halt the Bear Market that followed that bubble. In lowering interest rates too severely and for too long, the Feds inadvertently funded the Real Estate Bubble of 2003–2007 and provided the monies for the Mortgage-Backed Securities (MBSs) debacle and the Credit Default Swap (CDS) fiasco of 2008.

The problem with this theory that controlling “money flow” via raising and lowering the Fed’s interest rates to big banks is that the Feds have no control over how the big banks use the money lent.

Inflation is present in our economy. It is not where the Feds expected it to be. The Federal Reserve assumed wrongly that by keeping interest rates low, corporations would invest in infrastructure and in creating new jobs between 2009 and 2014. Such was not the case.

Corporations used the low interest money and their rising profits due to massive layoffs to buy back billions of dollars’ worth of their company stock, and reducing the outstanding shares are artificially inflating the stock price.

This benefited the corporations which were eager to create an environment where dividends would rise to satisfy their largest investors, the Dark Pools. It worked. By buying millions of shares of their own company stock, the stock price rose as fewer shares were available. It moved money out of manufacturing, out of infrastructure, and out of payroll increases and into the Stock Market.

In essence, the Fed’s attempt to control big businesses and big banks failed. Companies used the money to artificially inflate the Earnings Per Share (EPS) by reducing the number of outstanding shares. Nearly every major corporation had Buybacks sometime during those years.

What has happened because of this is inflation in the Stock Market rather than inflation in wages and consumer products, hence the below 2% inflation in an economy that has been stated as “robust”. Unemployment has fallen to record lows, but wage income is stagnated.

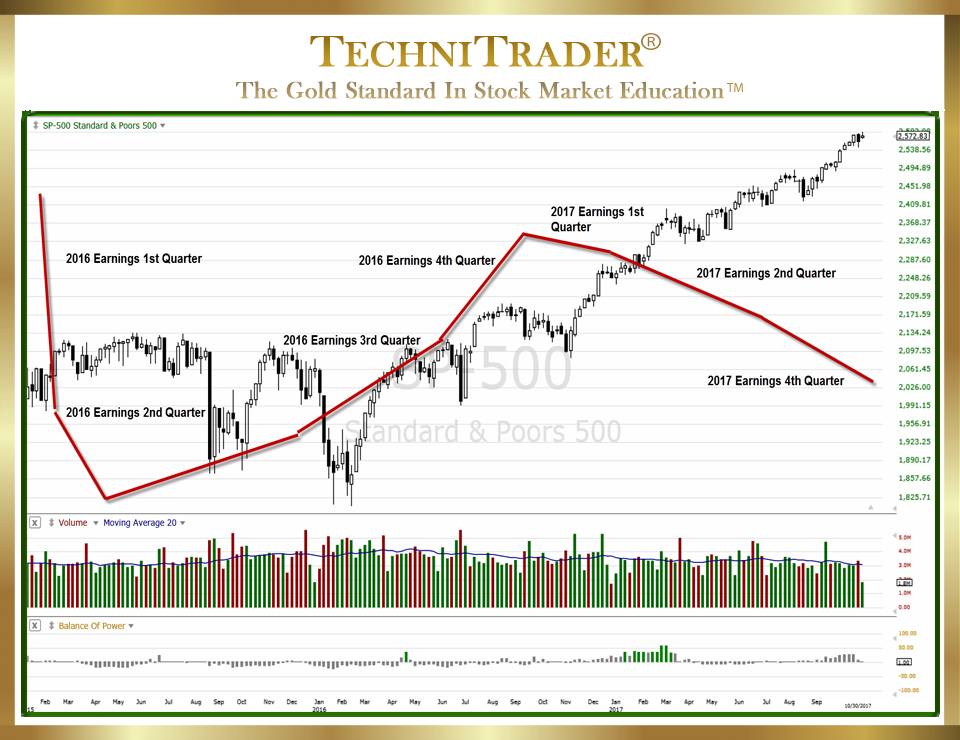

The chart example below shows the Negative Deviation of Fundamentals from stock values. The S&P 500 is running up. However, the S&P 500 companies have had lower earnings and revenues quarter over quarter since the end of 2016, when a Peak formed in the Earnings and Revenues Cycle.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.