New Candlestick Patterns from Wider Spread Programs

Stock Market Trading Opportunities Increase

The first pilot test program for wider spreads focused on small cap stocks and was initiated by the Securities and Exchange Commission (SEC). This provided more liquidity for these stocks and was a huge success, becoming the standard for all small cap stocks.

Following the nearly identical path, the Wilshire 5000 stocks were in a pilot test program that was very similar to the Small Cap Stock Pilot Test Program. Both are FORWARD-testing programs using real-time live market activity. This makes these test programs extremely reliable with a faster determination of whether or not the wider spreads help liquidity and short-term traders.

For Retail and Technical Traders, these test programs offer more trading opportunities, as the spreads are sufficiently wide enough to allow stronger runs for Swing Traders and stronger Platform Formations for Position Traders.

However, in order to take advantage of the wider spreads, Retail and Technical Traders need to learn the new Candlestick Patterns and Buy Entry Setups that now form. It has been over a decade since spreads were this wide on thousands of stocks with increased liquidity.

The wider spread program was initiated after many larger and giant Buy Side Institutions requested a wider spread for small caps to trade on a short-term basis.

It will impact the Retail Trader any time a major institution is actively trading millions of shares of stock for short-term profits via their now-large number of trading floor Professional Traders.

This is good news for all small-lot Retail Traders as they can ride the coattails of the Professional Traders getting in ahead of the High Frequency Traders (HFTs). Increasing short-term trading activity makes the Stock Market healthier and easier to trade. However, the New Candlestick Patterns from Wider Spread Programs are also changing price in subtle ways.

It is imperative to use all the Worden TC2000 Indicators that are designed to reveal larger-lot activity over smaller-lot activity. These help confirm that the price action is indeed a larger to giant institution that is Swing Trading a huge amount of stock.

In addition, Options Traders will need to be cautious about their interpretation of the Put/Call Ratio. These large-lot traders use Puts as insurance policies when they are short-term trading a huge number of shares. The cost of the Option Put to them is a small price to pay for mitigating risk. They use Option Puts instead of Stop Losses.

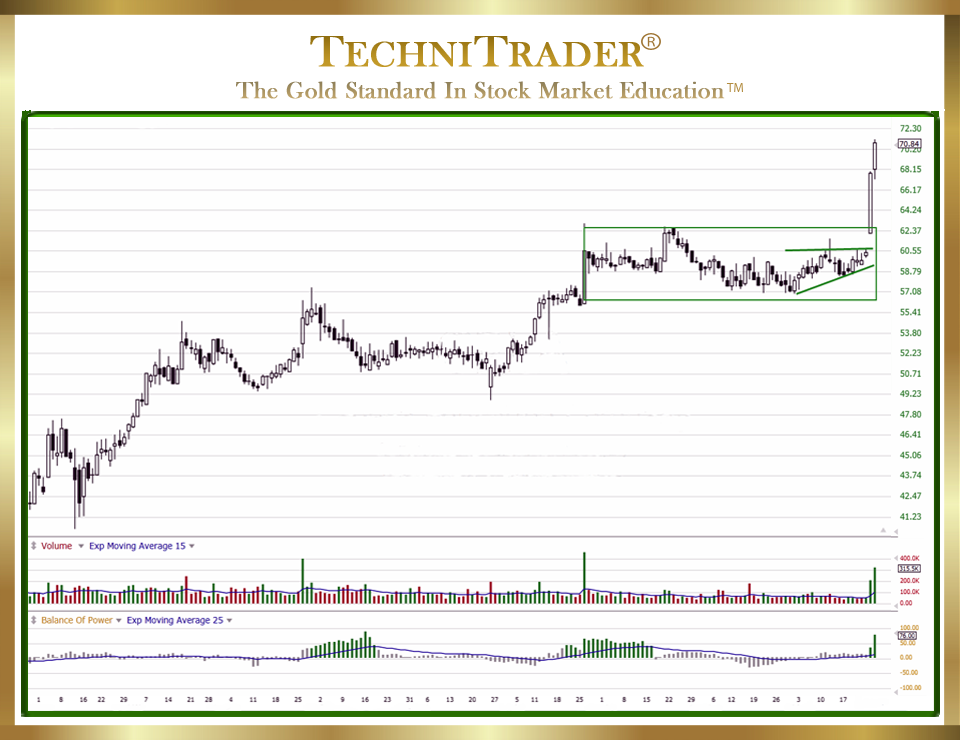

The chart below is a fine example of a small cap stock with 11 million outstanding shares that has benefited from increased liquidity and more active short-term trading.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2016–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.