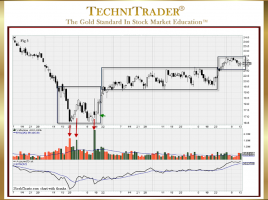

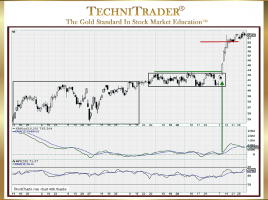

New Candlestick Patterns from Wider Spread Programs

Stock Market Trading Opportunities Increase The first pilot test program for wider spreads focused on small cap stocks and was initiated by the Securities and Exchange Commission (SEC). This provided more liquidity for these stocks and was a huge success, becoming the standard for all small cap stocks. Following the …