How to Interpret Extreme Candlestick Patterns

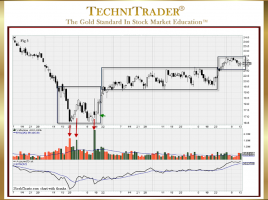

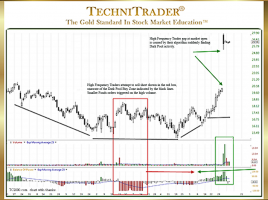

Identify Dark Pool Buy Zones™ in Stock Bottom Formations Every Technical Trader and Retail Trader knows that Bottom Formations are often completed with a Momentum or Velocity Run, but few are able to capture those big gains because they are unable to recognize the candlestick patterns that precede the run. …