What Is the Anatomy of a Swing Trade?

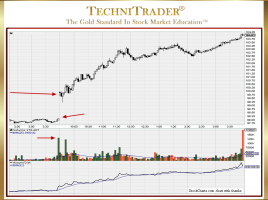

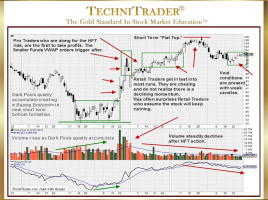

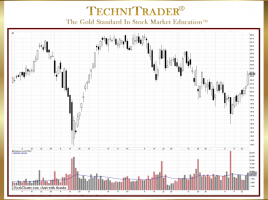

Identifying Large Lots Dominating Buy Side or Sell Side of Momentum Run The most common mistake Retail Traders make in choosing stocks for Swing Trading is to not identify whether the large lots are dominating the buy side or the sell side during the price action momentum run upward. This …