How to Track Large-Lot Institutions

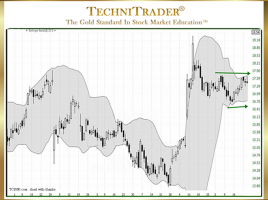

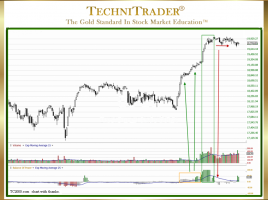

Learn to Identify Candlestick Patterns in Charts The main challenges Individual Investors and Retail Traders face today are figuring out when High Frequency Traders (HFTs) are going to suddenly appear and when Buy Side Institutions using Dark Pools are quietly buying or selling. There are distinct candlestick and indicator patterns …