Why Learn to Identify Bollinger Bands® Sideways Candlestick Patterns?

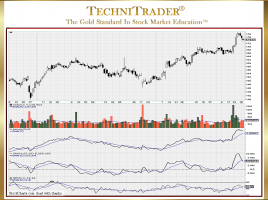

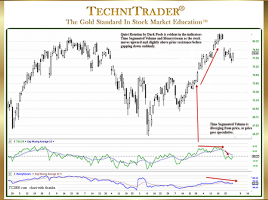

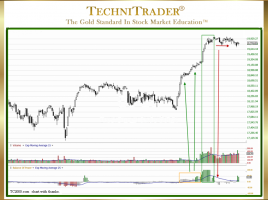

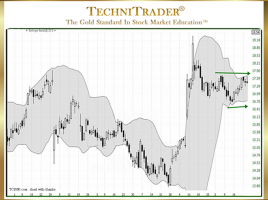

Find Candlestick Platforms Prior to Runs Using Bollinger Bands in TC2000.com Charts makes it far easier to determine if a Candlestick Platform is underway or if it is a wider sideways Trading Range candlestick pattern. Below is an example of a stock that had been in a Trading Range pattern …