How to Identify New Sell Short Topping Candlestick Patterns

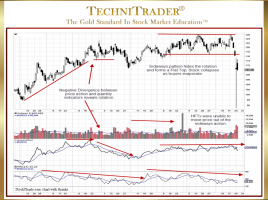

Add Stock Volume & Quantity Indicators to Analysis One of the challenges for Technical Traders is learning the new Topping and Bottoming Candlestick Patterns that have emerged in the past few years. The Topping Candlestick Patterns in the markets today can be a surprise for traders. Learning How to Identify …