What Is Dark Pool Quiet Rotation™?

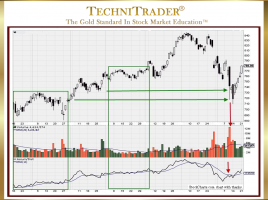

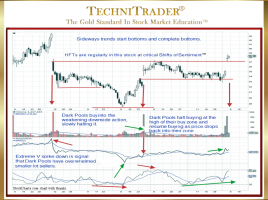

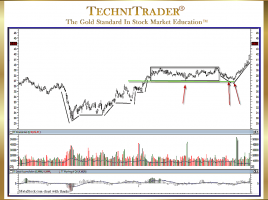

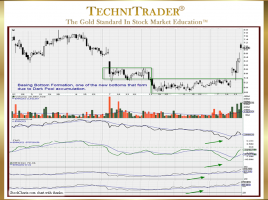

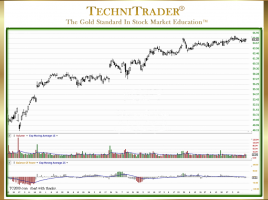

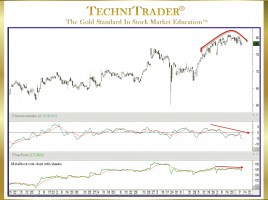

Candlestick Patterns Explained with Stock Indicators Most Technical and Retail Traders have heard about Buy Side Institutions’ Dark Pool Quiet Accumulation and Quiet Distribution, but few understand another institutional action which is Dark Pool Quiet ROTATION. The candlestick chart example below with a monthly view shows the commencement of a …