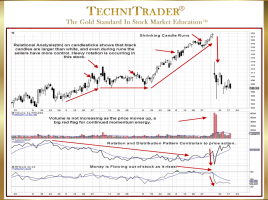

Relational Technical Analysis™ Reveals Hidden War on Wall Street

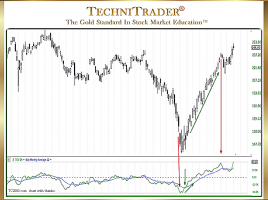

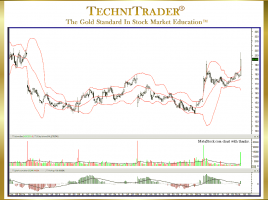

Buy Side Institutions vs. Sell Side Institutions There is a hidden world within Wall Street that the average Retail Trader never sees or hears about. Right now, two powerhouse sides of the market are at war with each other. It is the Buy Side Institutions vs. the Sell Side Institutions. …