What Is the Anatomy of a Swing Trade?

Identifying Large Lots Dominating Buy Side or Sell Side of Momentum Run

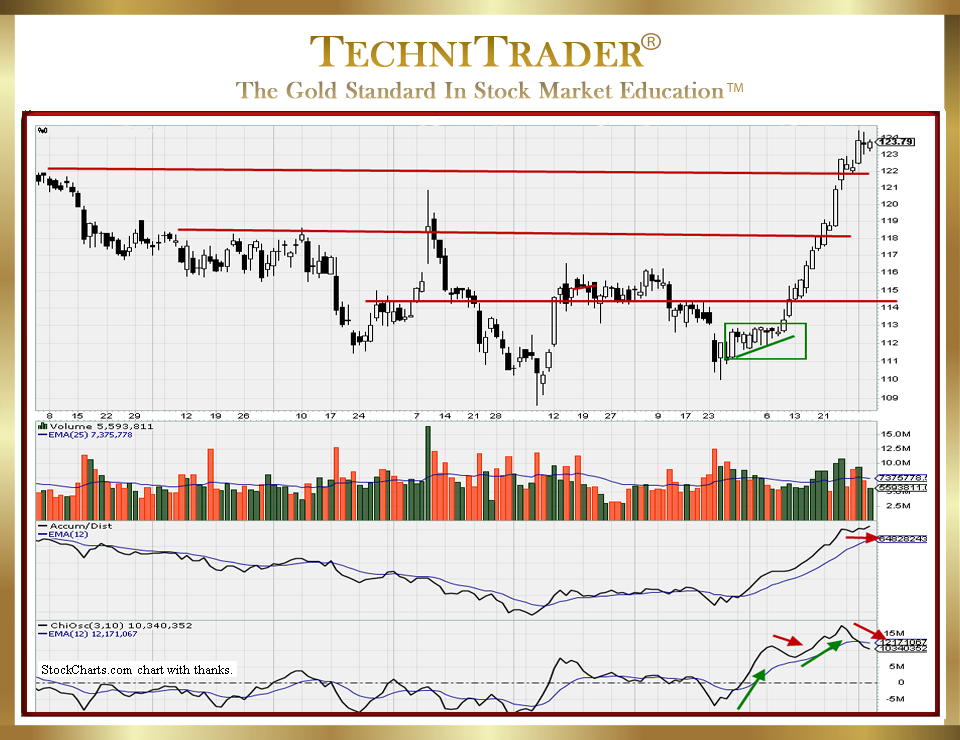

The most common mistake Retail Traders make in choosing stocks for Swing Trading is to not identify whether the large lots are dominating the buy side or the sell side during the price action momentum run upward. This is the primary cause of most whipsaw action in a Swing Trading run.

Many traders want to blame “market makers” for whipsaws or even High Frequency Trading; however, price data and Market Structure refute both as the real cause. Almost all market making is via a computer, and High Frequency Traders (HFTs) trade mostly in the first few minutes of market open.

The real reason why most traders encounter whipsaw action in their swing trades is not recognizing when the large-lot Professional Traders switch from buying a stock to drive price upward to selling for profits. Professional Traders use carefully orchestrated routing and sell orders that maintain the upward action even while they are selling to close positions.

Swing Trading Strategies need to incorporate Technical Analysis of the stock’s price and stock volume patterns in order to determine whether the Professional Traders, who often swing trade stocks, have shifted from buying to selling mode and what that will mean for near-term price action movement.

For the first analysis, ask yourself: Is this a momentum run or a velocity run? The structure of each type of stock price action run is totally different in terms of how the price movement behaves.

LEARN MORE at TechniTrader.Courses

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock & Option Courses

Copyright ©2017–2025 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.