TechniTrader® Hybrid Indicators for MetaStock Users

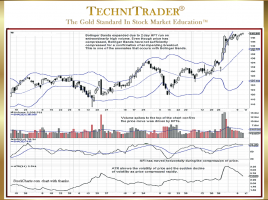

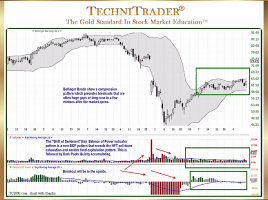

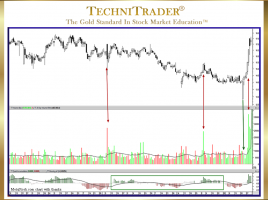

About TechniCators™ and Market Conditions for Trading or Investing TechniTrader Stock Market Education groups indicators together based on obtaining a complete and thorough analysis of all the Market Data available. These are typically 5 Hybrid Indicators we created. Each group is called a “TechniCator”, and there are TechniCators for each …