Elliott Wave Trading Strategies

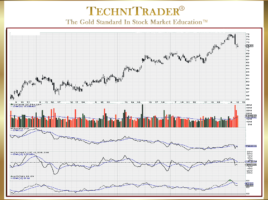

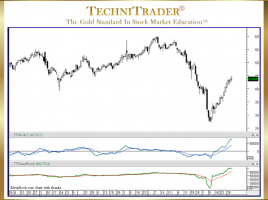

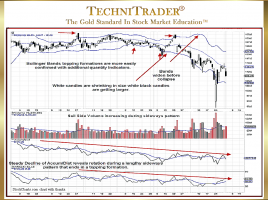

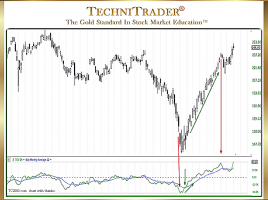

How to Understand the Wave Cycles for Entries and Exits The foundation of the Elliott Wave Theory is from the Charles Dow Theory that the market moves in waves and cycles. These cycles have been altered in recent years due to the massive internal structural changes of the Stock Market …