How to Cope with Volatile Trading Conditions

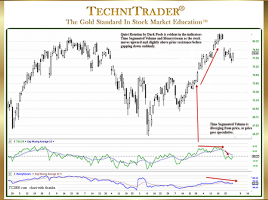

Find Stocks That Have Compressing Sideways Candlestick Patterns Trading so-called “Volatile Markets” can seem like a daunting task. Many Retail Traders struggle during these phases of trading action and do not recognize how to cope with “Volatile” Trading Conditions. The problem is not that stock price action is “Volatile”, but …