MACD Trading Strategies for Bottoming Entries

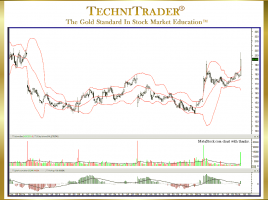

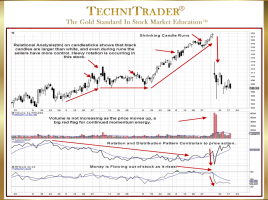

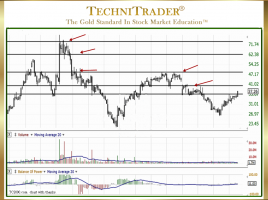

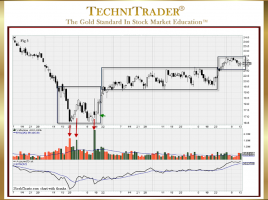

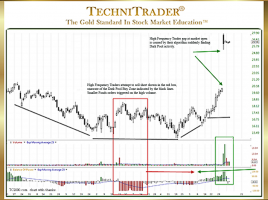

Types of Indicators to Use After a Downtrend One of the tougher things to learn in trading is the right time to enter a stock after a long downtrend. Many times, traders are too eager and get into a stock that looks as if the bottom is well underway, but …