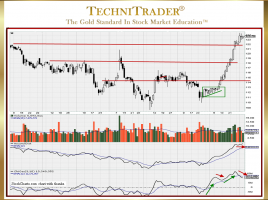

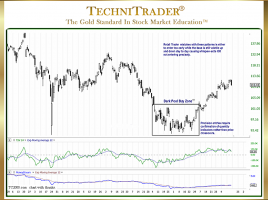

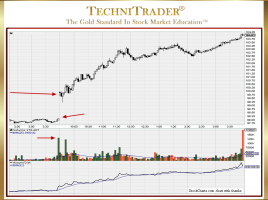

Time Segmented Volume a Bottoming Stock Formation Indicator

Enter Stocks Earlier for Swing Trading Gains One of the tougher technical patterns to determine is when stocks are going to stop trending down and begin Bottoming Stock Formations. This is especially important for Swing Traders as most bottoms have periods of momentum action as energy builds up due to …