What Is a Low-Risk Stock Entry Candlestick Pattern?

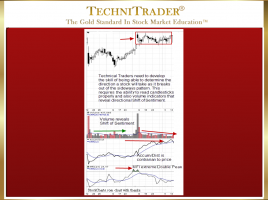

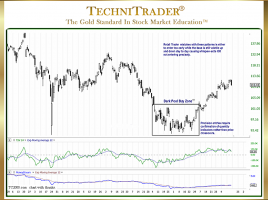

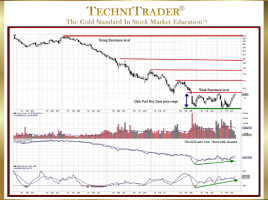

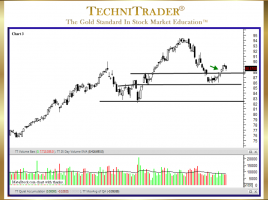

Bottoming Formation When a Stock Stops a Downtrend Trading Stocks is becoming an alternative career for many people. It offers a variety of opportunities and advantages that working for a corporation does not. The first step in learning how to trade stocks successfully is to understand what you need to …